GHR beyond - Mauritius

05.09.2023 Publications

A contribution by

In cooperation with

Rajiv Gujadhur

Nafiisah Jeehoo

Sadia Soodeen

Veneesha Doorgakant

Mauritius

Overview

Mauritius has had low but steady growth rates over the last few years (averaging 3.8% per year during the period from 2015 to 2019, reaching 8.7% in 2022) and is among the most dynamic economies in Sub-Saharan Africa. Overall, the country’s economy is driven by the services sector, which accounts for around 66.9% of GDP, with tourism (catering, accommodation, leisure, etc.) and financial services being the most vital sectors, with the latter accounting for 13.1% of GDP. In line with its vision for 2030, the Government aims to double the size of its financial sector and grow its contribution to GDP.

The country's economy is diversified and also relies on its offshore financial activity (the Mauritius International Financial Centre (IFC) has been a key driver for employment creation and the growth of related services), textile industry and production of sugarcane. Medical tourism, outsourcing, renewable energies, new technologies and the luxury industries are among the developing sectors. Overall, the industrial sector accounts for 18.3% of GDP, while the agricultural sector contributes around 3.3%.

About 670 Swiss nationals live in Mauritius, while about 840 Mauritian nationals live in Switzerland.

In this issue of the GHR beyond, we shall focus on main legal questions for Swiss direct investors into Mauritius, as well as we shall – a bit more general – focus on structuring possibilities for foreign direct investments with smaller ticket sized, which might be of particular interest for Start-Up and SME-Investors.

To Mauritius from Switzerland

Investing in Africa, Asia and Europe – the Mauritius IFC

A non-citizen seeking a presence in Mauritius through an investment vehicle established to conduct business outside Mauritius, may do so through entities holding global business licenses (GBL). By holding a GBL, which is itself subject to the financial services regulator in Mauritius being satisfied that the entity is managed and controlled from Mauritius, significant benefits may be achieved through the wide network of Double Taxation Avoidance Agreements (DTA) entered into by Mauritius and various jurisdictions worldwide, but principally in Africa, Asia and Europe. In order to benefit from the DTA, the investment should be made by a ‘resident of Mauritius’ which will, for a foreign investor, be through the holding of a GBL.

There are many other reasons to invest through Mauritius which cannot be overlooked by an investor contemplating an investment outside Mauritius. Effectively, a foreign investor who establishes a presence in Mauritius through the incorporation and setting up of its business shall be entitled, amongst others, to the benefits of the following agreements entered into by the Government:

The Investment Promotion and Protection Agreements (IPP) with Switzerland

Each country is to encourage and facilitate investments in its territory and shall, to the extent possible, admit or approve such investments. The agreement also prevents the nationalization or expropriation of investments of either country.

African Continental Free Trade Area (AfCFTA) agreement

It aims to create a single market across the African continent for goods and services while fostering free movements of persons and investments with a view to enhancing intra-Africa trade.

Mauritius-China Free Trade Agreement (China-FTA)

Mauritian exporters have immediate duty-free access to the Chinese market on 7'504 tariff lines and Mauritius offers a preferential tariff on imports entering Mauritius from China. Mauritius is also encouraging Chinese businesses to choose the country as their regional headquarters.

Comprehensive Economic Cooperation and Partnership Agreement with India (CECPA)

Mauritian exporters benefit from preferential market access to the Indian market on a list of 615 products such as special sugar, garments, medical devices and rums, and has obtained preferential access on food preparations, detergents, soaps, clock, watch parts and jewellery. India has also committed to provide market access on some 94 service sectors, including professional services, business services, financial services and telecommunications services.

Work and live in Mauritius

Mauritius offers numerous opportunities for investors, including those from Switzerland, to invest, live and work in the country. The following measures have been put in place to encourage foreigners and investors generally:

Premium-Visa

Non-citizens from selected countries including Swiss citizens along with their families can stay for a period exceeding six months and less than one year, with an option to renew, as tourists, retirees or professionals, working remotely from Mauritius.

Occupation Permit (OP) / Permanent Residence Permit (PRP)

An OP can be granted for a period of three years to non-citizens who are investors, professionals and self-employed. An investor who either makes a minimum investment of circa CHF 320'000 in a qualifying business activity or holds an OP for at least three years and has a minimum annual gross income of CHF 280'000 for the last three years, shall be eligible to obtain a PRP. The PRP shall be valid for a period of 20 years as from the expiry date of the OP which may be renewable for another 20 years.

Family Occupation Permit

An applicant, his/her spouse, dependent child, parent, other dependent or such other person working exclusively for the family unit may, on application, become a resident of Mauritius for a period of 10 years. The applicant is required to make a contribution of USD 250'000 to obtain such permit.

Tax incentives

Currently companies are eligible to claim either an 80% exemption on interest and foreign dividends, subject to certain substance requirements being met or foreign tax credits in respect of foreign tax paid on their ‘foreign source income’ against the income tax payable in Mauritius

where this can be evidenced. Moreover, the Government recently announced that there will be an increase in the existing partial exemption of 80% to 95% on interest earned by a collective investment scheme or a closed end fund. Additionally, there are no capital gains or withholding taxes on dividends applicable in Mauritius. Tax holidays are effective in sectors such as global headquarters administration, treasury activities and the manufacture of pharmaceutical products.

Premium Investor Scheme

Provides incentives such as rebates, exemptions and preferential rates which are negotiable with the relevant authorities in relation to taxes, duties, fees, charges and levies to companies involved in the manufacture of pharmaceuticals and medical devices and companies investing at least MUR 500 million.

As part of its ongoing initiatives in relation to the ease of doing business, Mauritius has embraced a comprehensive digital transformation allowing companies to be registered through online platforms, tax returns for individuals and companies to be filed through e-filing systems, and applications for the relevant permits for foreigners to be made through electronic licensing systems.

Conclusion

Mauritius possesses all the attributes, through its constant drive to innovate and highly skilled human resources, to meet the upcoming challenges that it will undoubtedly face. The Covid-19-induced crisis took a severe toll on the Mauritian economy, with GDP plummeting by an estimated 14.9% in 2020.

However, the country has shown resilience ever since with consistent growth in the ensuing years, so much so that Mauritius is expected to fully recover and converge to its pre-pandemic trend growth of 3% to 3.5% by 2025. Foreign investment will be key to the growth strategy of the country and, with the approach as enumerated in this paper for a conducive business environment, there is clear potential for growth in the Mauritius-Switzerland bilateral relationship, and more generally.

Small Ticket Direct Investment Structuring from Switzerland

Direct Investments into Africa – Possible Vehicles for Smaller Tickets

There is a relevant appetite from investors to directly invest into private equity (PE) or venture capital (VC) projects in Africa. Many investors for Africa wish to have direct investments into projects and select projects opportunistically. The do not only seek promising returns, but are often impact-driven.

A large amount of promising PE or VC investment opportunities are not suitable for big ticket sizes, but rather require smaller investment amounts (i.e. mCHF 5 or less) and are not only interested in funding, but also in finding business angels. Small ticket sizes in PE and VC projects are often critical for foreign (European) investors due to regulatory access restrictions and tax disadvantages, or relatively high costs due to compliance with financial market regulations.

The following overview aims to present potentially suitable investment vehicles for Swiss and European investors to go for smaller ticket sizes in African VC and PE projects and that are still allowing for certain tax optimization, have low operating costs, are open for as many investors as possible and are not or only poorly regulated by financial market supervisory authorities. The investment vehicles shall be suitable for direct investment tickets between mCHF 0.5 and 10, which could be pooled by a plurality of investors. The investment vehicles would be domiciled in Switzerland and subject to Swiss law.

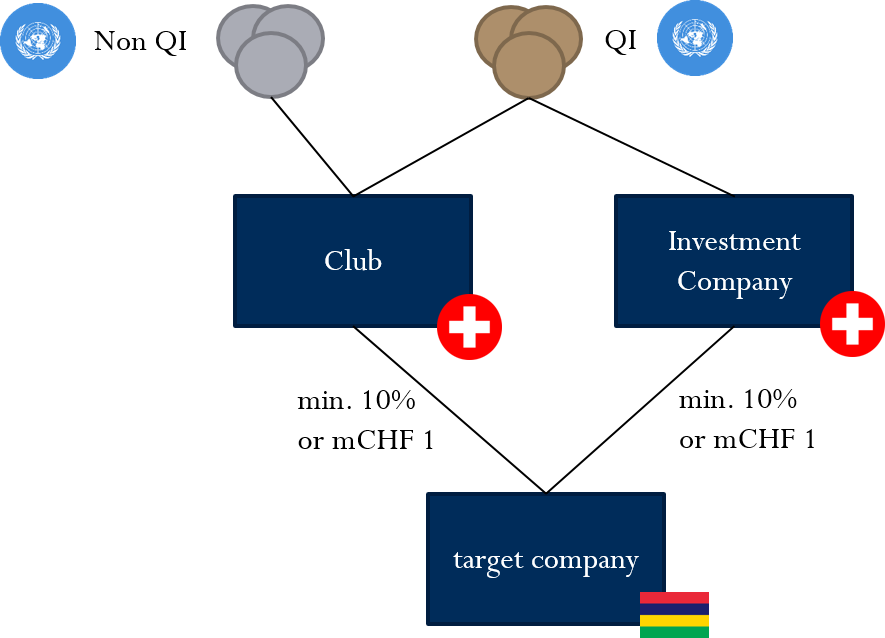

Investment Club (Club)

The Club is a non-regulated connection of investors who seek to commit for common investments. The Club can exist in the legal form of a company limited by shares (Ltd.) or as unregistered partnership. Investors can be qualified or non-qualified. The number of possible investors amounts to a maximum of 20, whereas the investors can be Swiss and foreign. The structure costs are low, whereby it should be noted that the emission levy (1% from CHF 1 million equity) is applicable. All investors have a say with regard to investment strategy and investment decisions, which must not be delegated.

The Club is suitable for smaller and rather single projects, which shall also be available for non-qualified investors. There is no minimum volume. It is a hybrid vehicle to partner equity, expertise and personal motivation.

Investment Company (IC)

The IC is a non-regulated investment company in the form of a company limited by shares (Ltd.), which shall only issue registered shares. All shareholders are qualified investors, i.e. they have bankable assets in excess of CHF 2 million. The number of investors is unlimited, whereas the investors can be Swiss and foreign. The structure costs are low, whereby it should be noted that the emission levy (1% from CHF 1 million equity) is applicable. The investment decisions are usually delegated to the board of directors or executive board.

The IC is suitable for larger projects with maximum entrepreneurial freedom and high flexibility (for qualified investors). The minimum volume is CHF 100'000.00.

Alternative Investment Fund (AIF)

The AIF is constituted as a Limited Qualified Investor Fund (L-QIF) pursuant to Swiss law or as an AIF pursuant to European Directive on Alternative Investment Fund Managers (AIFMD). The AIF has the legal form of an Investment Company with Variable Capital (SICAV) or a Fonds Commun de Placement (FCP). The number of investors is unlimited, whereas the investors can be Swiss and foreign. The structure costs are high, the emission levy (1% from CHF 1 million equity) is not applicable.

The manager of the AIF (AIFM) is regulated. Only qualified investors can invest in an AIF and they do not take investment decisions. Investment decisions are made by the AIFM only.

The AIF is not suitable for the projects in scope due to its high structural costs and, consequently, large ticket sizes.

Reasons and Advantages

The Club and the IC have lean corporate structures which cause comparably small establishment and running costs (establishment costs: legal and notary fees and regulation exemption confirmation from the Swiss Financial Market Supervisory Authority FINMA; running costs: fees and salaries of the board members). Further they are open for all, also retail investors with lower tickets. The regular company taxation in Switzerland is applicable, which is a favourable and stable tax regime, and the Double Tax Agreements (DTA) are fully applicable. Furthermore, Swiss tax law knows the principle of the so-called "participation deduction", allowing that the net earnings from the investment (dividends etc.) are as good as tax free on level of the Swiss vehicle, even if there is no DTA in place with the domicile country of the target company. Requirement: Participation amounts to at least 10% of the total equity of the target company, or has a value of at least CHF 1 million, and shall be held for at least 1 year.

Template Participation Structure

Preparatory Work

The Articles of Association of the Club as well as the IC need to meet certain conditions to be exempted from FINMA regulation. Exemption confirmation is not mandatory, but highly recommended. Furthermore, offering structure should be revised to avoid applicability of prospectus liability.

The tax situation can vary, depending on the domicile of the investor, the domicile of the target company, and the ticket size of each investor. The respective tax situation is recommended to be assessed prior to execution.

How it is in Practice

Knowing the legal requirements for intercontinental business relations is only one side of the coin. It is at least as important to get involved in local everyday life and to be able to deal with the particularities and customs.

We met Patrick Héritier for an interview and asked him about his impressions. After starting his banking career in 1997 he joined Pleion in 2017 as CEO. The group Probus Pleion is a multinational and multidisciplinary group active in the financial industry in Switzerland, Luxembourg, Dubai and Mauritius. The group is present in Mauritius since 2006, and is represented by Djilani Hisaindee.

May you introduce yourself to our readers?

After ten years as a Swissair airline pilot, I transitioned into banking in 1997 by joining SBS/UBS, occupying progressive roles in credit and wealth management, director, and the Head of Private Banking for the Chablais region. I then joined Julius Baer, with the responsibility of opening and developing the Verbier branch. Promoted to the Private Bank’s Swiss Executive Committee, I was entrusted with the growth of the Central and Eastern Switzerland region, from Berne to St. Moritz. While cultivating my banking career, I also dedicated 30 years of service as a fighter pilot in the Swiss Airforce.

To complement my diverse professional experiences, I completed an Executive MBA from Rochester - Bern Universities and an Advanced Management Program at INSEAD Singapore. I also acquired a Certificate of Advanced Studies (CAS) in General Management as board member from the University of Bern.

In 2017, I embraced the opportunity to serve as the CEO of Pleion S.A., an independent wealth and asset manager active in Switzerland. After the merger with Probus Holding SA, I became one of the Managing Partner of Probus Pleion, a multinational and multidisciplinary group active in the financial industry active in Switzerland, Luxemburg, Dubai and Mauritius.

We are present in Mauritius since 2006, and the reasons of our establishment in Mauritius is manifold. There are a number of similarities between Switzerland and Mauritius, whether from a linguistic, cultural or political point of view. Our approach is to use the Group's Swiss and international expertise in wealth management to complement the skills acquired in Mauritius in the African markets.

What do you do?

Wealth management is our core activity. The recently merged Probus and Pleion form one of the most respected independent wealth management groups in Switzerland. By delivering a diverse and effective range of investment solutions, the group brings together a stronger team that focuses on enhancing our clients’ experience.

Operating in full compliance with stringent international financial services regulations, we are fully authorised to serve as wealth managers and investment advisers for our clients in the jurisdictions where we operate.

While wealth management is the group’s main activity, we have diversified our expertise and offering. Indeed, our entities provide services that seamlessly complement wealth management, including corporate services, legal and tax advice, IT, consulting and real estate, providing a holistic approach to financial management.

Our objective is to deliver tailor-made services to meet our clients' unique needs, empowering them to identify and capitalize on new investment and business opportunities. Our ultimate aim is to foster their growth and prosperity.

How did you come to build the bridge between Switzerland and Mauritius?

The success of Mauritius is based on its exemplary position. It ranks first in Africa for ease of doing business, global competitiveness, good governance, economic freedom, human development, democracy, quality of living, social progress.

As an effective trade and investment platform between Africa and the rest of the world, our strategy is to offer our customers the tools and solutions they need to do business through Mauritius. The country offers numerous investment opportunities and puts forward a number of distinctive factors that make its International Financial Centre (IFC) conducive to business.

Political and economic stability, as well as a strong regulatory framework, are the foundation of Mauritius' investment influence, attracting investors seeking a secure and reliable ecosystem to invest their capital. The factors that further strengthen the country’s position as an investment hub include its robust infrastructure; its skilled, bilingual and cost-effective workforce; its hybrid legal system (civil and common law); its bilateral and multilateral agreements; and its International Arbitration Centre.

The Mauritius IFC also counts a number of global players such as international banks, law firms, and accounting firms. Coupled with its range of products and services, it is the ideal jurisdiction for entrepreneurs and multinational companies, as well as High-Net-Worth Individuals looking to do business and grow at international level.

According to the Africa Wealth Report 2023 (by Henley & Partners), the total investable wealth held on the continent amounts to approximately USD 2.4 trillion as at December 2022. Between 2012 and 2022, Mauritius recorded a growth of 69% with a total of 4,910 HNWIs.

With a conducive platform to High-Net-Worth Individuals in terms of wealth structuring and succession planning, Mauritius positions itself as Africa’s regional hub for wealth management. With this in mind, we decided to add Mauritius to our network to diversify our expertise, enhance our service offering, and also tap into the huge potential of the African continent as a growth frontier.

With over 25 years of experience, out of which 17 years spent at management level, Djilani Hisaindee, represents our group in Mauritius. He holds a Post Graduate Diploma in International Taxation from the Royal Society of Fellows (US), and is a Fellow member of the Association of Chartered Certified Accountants (FCCA). During his career, he handled complex tax & finance related issues, strategic projects, Mergers & Acquisitions and system implementations in sectors including FMCG, healthcare, and logistics, for one of the biggest conglomerates in Mauritius. Moreover, he is also a member of the Mauritius Institute of Professional Accountants and was a founder member of the International Fiscal Association in Mauritius.

What do you particularly like about this activity, where do you see the greatest opportunities?

With several decades of industry experience, we take great satisfaction in engaging with clients, generating innovative solutions for complex challenges, and crafting strategies to enhance their current and future financial position. The dynamism of the equity market further adds to the enthusiasm of my profession.

The advent of fintech and Artificial Intelligence (AI) has made this period particularly exhilarating. These advancements are reshaping the way we operate by enhancing efficiency and effectiveness in our processes, thereby optimising client service across various jurisdictions with minimal disruptions and real-time access to data. Despite the geographical distances, technological advancements have fostered a sense of proximity with our Mauritian entities.

Mauritius may be a small island of 1'865 km², but it has distinguished itself on the international stage by being compliant with international best practices of the financial services industry, including all 40 requirements of the Financial Action Task Force (FATF).

Leveraging such a strong and proven jurisdiction simplifies business processes, extending beyond wealth and asset management to encompass the entire financial industry, including virtual assets with the VAITOS Act 2001, providing peace of mind to all our stakeholders.

Where do you see the biggest challenges and potential for improvement?

Mauritius has successfully transformed its economy from one relying on agriculture and manufacturing, to a service-oriented economy with a strong focus on human capital, which now contributes to 75.6% of the GDP (2022).

Today, Mauritius is currently grappling with the exodus of this strong human capital, with highly skilled and internationally qualified professionals leaving the country for other jurisdictions. Given its population of 1.2 million, the talent pool is understandably limited, and the brain drain serves to further exacerbate the situation.

Every jurisdiction has its shortcomings, and Mauritius is no exception. However, these issues are being progressively addressed. The Government, in its recent national budget, announced measures aiming at mitigating the migration of talent. Still to be approved and enacted, the proposed solution will simplify the employment process for expatriates looking to work in Mauritius, thereby filling the talent gap. This approach serves not only as a corrective measure but also an opportunity to further diversify and enrich our professional landscape.

What do you think is important to bear in mind when doing business between Switzerland and Mauritius?

Being compliant with international regulatory best practices and carrying out enhanced Due Diligence implies that certain transactions in Mauritius may require a more extensive process, contingent on their nature. However, this ensure that capital and investments are secure when using the Mauritian platform.

Mauritius is among the most advanced nations in Africa, attributable to its liberal market policies and enticing tax regime. Yet, conducting business can be challenging without local assistance. Our financial sector is built on trust, and partnering with the right local team is fundamental to our stability.

Each issue of GHR beyond is intercontinental, but also very local. We always prepare content with one of our local partners, with whom we collaborate on legal issues with local relevance. We sincerely thank our partners for this tremendous effort and the opportunity to build intercontinental bridges with local expertise on this side and the other.

This edition of GHR beyond - Africa Edition has been produced by the following authors and law firms. Please contact the authors at any time if you have any questions or require further information on a particular topic.

For content related to Swiss law

GHR Rechtsanwälte AG

Tavelweg 2 Seidengasse 13

3074 Bern Muri 8001 Zürich

Switzerland Switzerland

+41 58 356 50 50

Stephan A. Hofer

Partner

For content related to Mauritian law

Bowmans

3th Floor, The Dot

Avenue Del Talfair

Moka, Mauritius

+230 460 59 59

Rajiv Gujadhur

Partner

rajiv.gujadhur@bowmanslaw.com

Nafiisah Jeehoo

Senior Associate

nafiisah.jeehoo@bowmanslaw.com

Sadia Soodeen

Associate

Vaneesha Doorgakant

Associate

vaneesha.doorgakant@bowmanslaw.com